#Momentum Trading

Explore tagged Tumblr posts

Text

RSI: Your Secret Weapon for Better Trading Decisions

You know that feeling when you're always catching the market at the wrong time? Yeah, me too. That's until I discovered the Relative Strength Index (RSI), and boy, what a game-changer it's been! Let me share some real talk about this awesome tool.

First off, RSI is like having a market GPS - it helps you figure out if you're headed for overbought territory (above 70) or oversold land (below 30). But here's the kicker - it's not as simple as "buy low, sell high."

When I first started, I made the rookie mistake of treating RSI like a magic 8-ball. Every time it hit those magic numbers, I'd jump in without thinking twice. Let's just say my trading account wasn't too happy about that strategy!

Here's what actually works:

Watch for RSI trends, not just numbers

Pay attention when RSI and price are telling different stories

Use multiple timeframes to confirm your analysis

Don't forget about the overall market trend

Want to learn more? Check out my detailed guide on Relative Strength Index (RSI) for the full scoop!

#RSI indicator#trading analysis#market indicators#trading psychology#momentum trading#technical trading#RSI strategy#trading basics#market analysis#beginner trading

2 notes

·

View notes

Text

Momentum Trading: Forex Trading Strategy Explained

Momentum trading is a strategy that seeks to capitalize on the continuance of existing trends in the market. By focusing on the strength of price movements, traders can make informed decisions and optimize their profits. What is Momentum Trading? Momentum trading involves buying and selling currency pairs based on recent price trends. The core idea is that strong movements in the market tend to…

#Currency Pairs#Divergence#Economic Indicators#Forex#Forex Trading#Leverage#MACD#Market Conditions#Market News#Momentum Trading#Moving Average Convergence Divergence#Moving Averages#Price Movements#Relative Strength#Risk Management#RSI#Stochastic Oscillator#Stop-Loss#Stop-Loss Orders#Take-Profit#Trading Strategy

3 notes

·

View notes

Text

Momentum trading with insights from seasoned industry experts. This program will equip you with proven strategies to identify trends, capitalize on price movements, and make informed decisions in fast-paced markets.

#trading strategies#Learn to trade momentum stocks#momentum trading#relative strength index#breakout strategy#contrarian strategy#pullback strategy#momentum trading strategy

0 notes

Text

Understanding Momentum and Price Divergence: A Key Trading Edge

In trading, one of the most powerful concepts is that momentum moves before price. The chart below illustrates this beautifully. By observing the momentum oscillator (the lower section of the chart), you’ll notice something critical—divergence.

Divergence occurs when the momentum indicator shows weakness or strength in a direction before the price reacts. For example, as the oscillator begins to decline or lose steam while the price creates higher highs, this signals a potential reversal or weakness in the upward trend. This gives traders a clear indication of what might come next.

Momentum is like the engine behind price action. Paying close attention to it allows you to anticipate market moves before they happen. This means you can position yourself more strategically, rather than reacting after the price has already moved.

Understanding this concept isn’t just a theory—it’s a proven tool that successful traders use daily to predict future market movements. Take the time to analyze momentum and divergence in your charts. It could be the edge you’ve been looking for in your trading journey! 🚀

What do you think about using momentum indicators in your trading? Let’s discuss below! 📈

#forextrading#momentum trading#price action#tradingtips#technicalanalysis#DivergenceTrading#ForexStrategies#MomentumOscillator#TradingEducation#MarketAnalysis#TradingCommunity#LearnToTrade#TradingEdge#DayTrading#ChartPatterns

0 notes

Text

Are You a Momentum Investor or a Value Investor? | Finology Quest

Discover the differences between momentum investing and value investing in this comprehensive course by Finology Quest. Learn about various investing concepts, managing risk, and judging companies in spin-off scenarios. Join industry experts, Manish Dhawan and Dayanand Deshpande, as they share their insights and strategies. Perfect for momentum traders, finance students, and individuals with basic knowledge of technical analysis. Start learning today and gain access to PDFs, flashcards, assessments, and a certificate of completion.

0 notes

Text

when teachers tell you to stay in school they are NOT fucking lying

#i stopped going to school at 15 and it will actually be extremely hard to do anything now#like i didnt need to do any higher exams...#BUT i need to be able to say ive done them#and i could do them now#once i figure out if im gonna try and do higher education#but like im just kinda hoping i figure it out somehow#i could do an access course. all is not lost#but it would be exetremely better for me now if teenage me would have done all this shit when she had a more than one teacher#practically begging her to#but i think i would have ended up killing myself and i have experienced so much growth since then#like i wouldnt actually trade what ive done since i left cuz it has just made me like an all around more confident person#but jesus#life has stalled a little bit. i need to get momentum back cuz everyday is the same#and im chronically fucking bored#is it ok to still not know what you wanna br when you grow up at 22???? asking for a friend.

4 notes

·

View notes

Link

Demystifying MACD: Mastering Momentum Analysis

"Mastering MACD Indicator for Informed Trading"

This article unveils the powerful MACD (Moving Average Convergence Divergence) indicator, an essential tool for traders and investors in deciphering market trends and momentum. Developed by Gerald Appel in the 1970s, MACD uses the difference between two Exponential Moving Averages (EMAs) to identify potential shifts in price trends and velocity. The article delves into the key components of MACD – the MACD Line, Signal Line, and Histogram – and provides their respective formulas and interpretations. By highlighting practical applications such as trend following, detecting overbought/oversold conditions, and utilizing various signal crossovers, the article equips readers with valuable insights into making informed investment decisions.

Whether for newcomers or experienced traders, the comprehensive understanding of MACD's components, usage scenarios, limitations, and tips for successful implementation enhances one's technical analysis toolkit, offering a robust foundation for strategic trading.

2 notes

·

View notes

Text

Indian Stock Market Next Week: Will Nifty and Sensex Break Key Levels on Monday 24-03-2025?

” How the Indian stock market will move next week starting 24-03-2025. Get key technical calls for Nifty and Sensex, trading strategies, and expert insights on support/resistance levels, momentum trading, and sector rotation. Stay ahead with actionable tips for maximizing gains in a volatile market. Read now!” The Indian stock market is a dynamic and ever-evolving ecosystem, influenced by a…

#Indian stock market next week#Infosys stock performance#momentum trading strategy#Nifty 50 technical analysis#Nifty and Sensex predictions#options trading in Indian stock market#Reliance Industries stock analysis#sector rotation strategy#Sensex support and resistance levels#trading strategy for Nifty and Sensex

0 notes

Text

#earn through momentum trading#learn momentum trading#momentum trading#elearnmarkets#investment course for beginners free

0 notes

Text

Momentum Loses Its MoJo, and the Risk Trade Gets Wrecked

Episode 228 of the Investopedia Express podcast with Caleb Silver (March 3, 2025) NurPhoto / Contributor / Getty Images Subscribe Now: Apple Podcasts / Spotify / PlayerFM February was a short and brutal month across the capital markets as the momentum trade into Big Tech and A.I. stocks reversed, leaving a pile-up of major losses across investors' favorite stocks. The White House dropped a new…

0 notes

Text

GIFT Nifty Indicates Muted Opening; UCO Bank Hikes Lending Rates by 5bps for Certain Tenures

for more details click here

#William J. O'Neil (William O Neil)#CANSLIM#Indian Stock Market#Stock Market Research#Market Outlook#Stock Screener#Stock Watchlists#Chart Pattern#Stock Analysis#Breakout Stocks#Stocks to Watch#Stocks to Buy#Growth Stocks#Stock Investing#Stock Trading#Momentum Investing#IPO Stocks#Fundamental Analysis#Technical Analysis#Stock M#arket Courses#Best Sector To Invest#Top Stock Advisory Services

1 note

·

View note

Text

0 notes

Text

On-Balance Volume (OBV): Forex Trading Indicator Explained

On-Balance Volume (OBV) is a technical analysis indicator that uses volume flow to predict changes in stock price. It was developed by Joe Granville in the 1960s and has since become a staple tool for traders. What is On-Balance Volume (OBV)? OBV is a momentum indicator that measures buying and selling pressure. It works on the principle that volume precedes price, meaning that significant…

View On WordPress

#Forex Trading#Market Trends#Momentum Indicator#OBV#On-Balance Volume#Price Prediction#Technical Analysis#Trading Strategies#Volume Analysis#Volume Indicator

1 note

·

View note

Text

youtube

🔥Comment réussir en Swing Trading avec l’EFFET ÉVENTAIL ?

📊 Vous cherchez à repérer les MEILLEURS SIGNAUX en swing trading ? Découvrez l’EFFET ÉVENTAIL, une technique puissante qui vous aide à détecter les opportunités de marché et à entrer au bon moment !

📌 Dans cette vidéo, vous allez apprendre :

✅ Qu’est-ce que l’EFFET ÉVENTAIL et comment il fonctionne en swing trading 🎯

✅ Comment l’utiliser pour capter des signaux de qualité et optimiser vos entrées 📈

✅ Exemples concrets et astuces PRO pour intégrer cette méthode dans votre routine de trading 💰

🔥 Si vous cherchez une technique efficace pour améliorer vos résultats en trading, cette vidéo est faite pour vous !

#stock market#investir en bourse#comment investir en bourse débutant#swing trading#bourse#stratégies d’investissement#grandes stratégies d'investissement#les stratégies d'investissement#actions qui explosent#trading moderne#concepts avancés trading#trading efficace#optimiser ses trades#comment mieux trader#meilleures stratégies de trading#tradingview#comment repérer les tendances#trading actions#momentum trading#rentabilité trading#signaux trading#détecter les tendances#Youtube

0 notes

Text

The investment landscape is an ever-evolving landscape with new strategies to cater to the needs of all types of investors. Systematic Plans have gained significant traction among investors in the last four to five years.

#stock market#elearnmarkets#stock trading#investing stocks#stockstowatch#momentum trading#earn through momentum trading

1 note

·

View note

Text

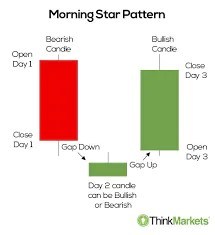

Mastering the Morning Star Pattern: A Step-by-Step Guide

Title: Mastering the Morning Star Pattern: A Step-by-Step Guide Introduction:The world of technical analysis offers traders a plethora of tools to identify potential trend reversals and market opportunities. One such powerful pattern is the Morning Star pattern, a three-candlestick formation that signals a potential bullish reversal after a downtrend. In this step-by-step guide, we will explore…

View On WordPress

#bullish reversal#candlestick patterns#comprehensive trading approach.#confirmation factors#doji candle#downtrend#false signals#market sentiment#momentum shift#Morning Star pattern#position sizing#price action#resistance levels#Risk Management#spinning top#stop-loss#support levels#technical analysis#trading strategy#trading volume#Trend Reversal#volume analysis

0 notes